Upgrade provides unsecured own loans and secured loans that make use of your vehicle as collateral. There are various approaches you can obtain a reduction with your desire charge, including creating autopay any time you apply, utilizing all or section of your loan to pay back financial debt or pledging your automobile as collateral. Read through our Update personal loans evaluate.

For those who have credit history troubles and want funds for residence improvements, you may want to consider using an FHA loan. Borrowers with superior to outstanding credit score can have A neater time justifying an $85,000 personalized loan.

“Qualified confirmed” signifies that our Economic Critique Board carefully evaluated the posting for precision and clarity. The Evaluation Board comprises a panel of financial specialists whose objective is to make sure that our written content is always goal and well balanced.

Pupil loans guidePaying for collegeFAFSA and federal pupil aidPaying for career trainingPaying for graduate schoolBest personal college student loansRepaying college student debtRefinancing student financial debt

Using a HELOC, you could draw on the credit history line as you'd using a credit card. After the attract period finishes, you repay the cash more than a specific length of time. There’s a chance associated since the loan is secured by your home, but house fairness financing might be handy to cover huge charges like property updates or higher education tuition.

It could be in the vicinity of unachievable to seek out a private loan expression more time than 12 many years. If you need a longer loan term, you might have to look for a secured loan solution.

To protect your privateness Remember to pay attention to the conditions of use and defense of your individual facts.

Have an Energetic checking account and provide account info (Examine or routing and account amount)

Know your credit history rating. First, Examine your credit history rating. With this information and facts, you’ll know more info which kind of interest charges you could possibly qualify for and can estimate the whole cost within your loan.

You'll find exceptions, though. For illustration, Rocket Mortgage suggests it's going to approve VA cash-out refinances for anyone with credit rating scores as little as 580 should they’re leaving not less than ten% equity of their assets.

Payoff day: The day you’ll make your last loan payment. Your start off day and loan expression figure out the payoff day.

Monthly payment: The quantity you pay out the lender each and every month for that life of the loan. Part of Just about every payment goes to desire and The remainder goes on the principal.

Cash-out refinancing isn’t the sole solution to faucet into your own home equity. You could potentially also take into account a house fairness line of credit history (HELOC) or a home equity loan.

Get prequalified. Acquiring prequalified is A fast strategy to preview an estimate with the loan amount of money you may borrow, the desire fee plus the repayment phrase.

Marques Houston Then & Now!

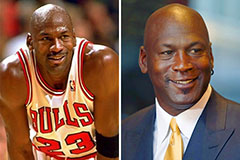

Marques Houston Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Mike Vitar Then & Now!

Mike Vitar Then & Now! Kane Then & Now!

Kane Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now!